Navigating Your Way to the Best Loan Options in Australia

- Personal Finance

- 03 Mins read

Navigating Your Way to the Best Loan Options in Australia

Considering a loan can seem overwhelming. The variety of choices available in Australia—from personal loans to home loans—can make anyone hesitate. As a finance author and a mortgage broker for over ten years, I've helped countless Australians find the right fit. My goal here is to simplify the process, so let's explore the loan landscape together.

Understanding Loan Types

Loans come in many forms, tailored to different needs. Let's break down the most common types, so you can make an informed decision.

1. Personal Loans

A personal loan is money borrowed from a bank or lender that you repay over time. Typically used for smaller expenses, these loans are unsecured, meaning you don't need to provide collateral. This makes them accessible but often with higher interest rates.

- Uses: consolidating debt, home renovations, emergency expenses

- Loan terms: 1-7 years

- Average interest rate: 7-14% (source: ASIC)

2. Home Loans

A home loan, or mortgage, is for purchasing property. The property acts as collateral, meaning the lender can take ownership if you default.

- Uses: buying a house, refinancing, investment properties

- Loan terms: up to 30 years

- Average interest rate: 2-6% (source: RBA)

Calculating Interest: Imagine buying a home with a $500,000 loan at a 3% interest rate over 25 years. Your monthly payment would be approximately $2,372, with a total repayment close to $711,600. This showcases how interest compounds over time.

Quick Tip: Consider offset accounts to reduce the interest paid on your home loan.

3. Car Loans

Car loans help you finance the purchase of a new or used vehicle. These can also be secured or unsecured.

- Uses: buying new or used cars

- Loan terms: up to 7 years

- Average interest rate: 6-10%

4. Business Loans

For entrepreneurs and small business owners, these loans provide essential capital.

- Uses: expanding operations, buying equipment, managing cash flow

- Loan terms: varies greatly

- Interest rate: can vary depending on creditworthiness and market factors

5. Student Loans

These provide financial assistance for education, typically with more favorable repayment terms.

- Uses: covering tuition fees, books, living expenses

- Interest rate: tied to inflation (e.g., HELP loans)

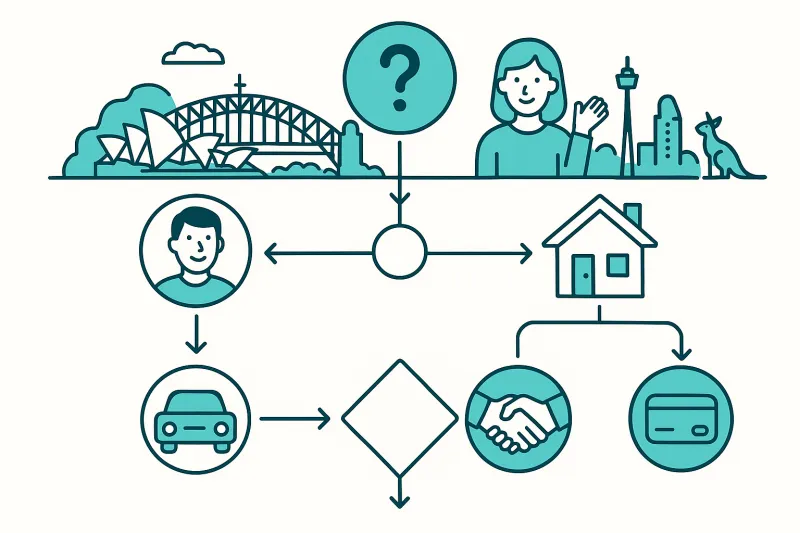

Choosing the Right Loan for You

Deciding on a loan involves understanding your needs, financial situation, and future goals. Here's how you can navigate this decision-making process:

Assess Your Needs

What is the purpose of your loan? Define your needs clearly to narrow down options.

- Need a vehicle? Consider a car loan.

- Planning to buy a house? Home loans are your go-to.

Evaluate Your Financial Health

Your current and projected financial situation will dictate loan terms you can realistically manage.

- Income: what can you afford?

- Credit score: a better score often means better terms.

In my experience, a family wanting to consolidate debt benefited greatly from a personal loan; it simplified their payments and reduced their interest burden.

Compare Lenders

Not all lenders are created equal. It's crucial to shop around.

- Consider both large banks and smaller, flexible lenders.

- Evaluate customer service, as it can significantly affect your experience.

Understand Terms and Conditions

Always review the fine print. Interest rates, fees, and terms/types of interest can vary widely.

- Fixed rates: stable but potentially higher

- Variable rates: fluctuate with market changes

The Application Process

Feeling ready to apply? Here's what comes next:

Gather Documentation: You'll need proof of income, identification, credit history, and proof of assets or debts.

Pre-approval: This step, especially for home loans, gives an estimation of how much you can borrow.

Formal Application: Fill out applications honestly. Discrepancies could prolong the process or lead to rejection.

Notice: It’s crucial to keep copies of all correspondences and agreements for your records.

Final Thoughts on Loan Management

Loans are tools to enhance your financial well-being, not burdening liabilities. In my career, I've seen how understanding loans can transform lives. Here are some closing strategies:

- Budget Wisely: Ensure repayments fit into your monthly expenses.

- Build an Emergency Fund: Protect yourself against unexpected hardships.

- Stay Informed: Regularly review and adjust your strategy as your financial landscape changes.